More Option

What is Cryptocurrency?

Unlike other asset classes (FX, Equities, CFDs on Commodities, etc.), the Cryptocurrency market is dominated by retail speculators. With (BCT) Cryptocurrency CFDs, you will trade in a market where there is no central bank intervention, interbank dealers controlling order flow or giant pension funds moving prices.

Price movements on Cryptocurrencies like Bitcoin or Ethereum are driven primarily by news and prevailing sentiment, i.e. the fear and greed of retail speculators. These sometimes dramatic shifts can lead to massive intraday price swings, making Cryptocurrency CFDs an exciting product for aggressive and experienced day traders.

The (BCT) Cryptocurrency CFD product allows traders to go long or short without actually holding the Cryptocurrency. This means traders can get exposure to the price of the Cryptocurrency without worrying about the security risks associated with storing it and the counterparty risk from the exchange. This is similar to trading Energy Futures such as oil rather than owning physical oil to speculate on its price.

Cryptocurrency CFDs

Facts

- 1:200 Leverage MetaTrader4/MT5

1:5 Leverage BullCopytrade - Trade the market 7 days a week

- Long or short

- FSA regulated

- No commissions

- REAL live support!

Bitcoin CFD

The first and largest cryptocurrency, Bitcoin paved the ways for hundreds of similar currencies and boasts a market cap of over $100 billion.

Ethereum CFD

The world's second-largest cryptocurrency, it is labelled by many as 'the next Bitcoin'. Ethereum has received international recognition and support from giant organisations such as Microsoft, JP Morgan, and Intel.

Dash CFD

Dash's focus is on instant transactions and owner privacy. Dash has an infrastructure that enables much faster transactions than other cryptocurrencies and therefore displays higher liquidity than many of its counterparts.

Litecoin CFD

Designed by a former Google engineer to improve upon Bitcoin's technology, Litecoin offers quicker processing times and a larger number of tokens. It is also the first cryptocurrency to implement SegWit, a method of speeding up transaction times without compromising the underlying blockchain technology.

Bitcoin Cash CFD

Bitcoin Cash resulted from a hard fork of the Bitcoin blockchain. It increased block size from 1 megabyte to 8 megabytes without incorporating SegWit.

Ripple CFD

Ripple is both a transaction network and crypto token which was created in 2012 as the go-to cryptocurrency for banks and global money transfers, and has recently experienced a period of growth.

EOS CFD

EOS is a decentralized operating system based on blockchain technology. It is designed to support of decentralized applications on a commercial-scale by giving all the required core functionalities.

Emercoin CFD

Emercoin is an open-source cryptocurrency which originated from Bitcoin, Peercoin and Namecoin. Other than being a cryptocurrency, it is also a platform for secure distributed blockchain business services.

NameCoin CFD

Namecoin is a blockchain protocol that serves as a naming system. Since Namecoin is a fork of Bitcoin, it is also a cryptocurrency that can be used for peer-to-peer transactions.

PeerCoin CFD

PeerCoin aims to solve the inefficiency problem of the Proof-of-Work that is used by bitcoin and many other coins using its own Proof-of-Stake system.

Polkadot CFD

Polkadot is a platform that allows diverse blockchains to transfer messages, including value, in a trust-free fashion; sharing their unique features while pooling their security. In brief, Polkadot is a scalable, heterogeneous, multi-chain technology.

Stellar CFD

Stellar, or Stellar Lumens, is an open source, decentralized protocol for digital currency to fiat money low-cost transfers which allows cross-border transactions between any pair of currencies.

Chainlink CFD

Chainlink is a decentralized oracle network and cryptocurrency that provides data to blockchains. It is one of the main sources of data used to feed information to applications in decentralized finance.

Dogecoin CFD

Dogecoin was founded by software engineers Billy Markus and Jackson Palmer, as a payment system. This coin began as a 'meme coin' and is now seen as a popular option for traders.

Tezos CFD

Tezos is a decentralized and Proof of Stake blockchain network that can perform peer-to-peer transactions and assists as a platform to arrange smart contracts.

Uniswap CFD

Uniswap is used to exchange cryptocurrencies. It enables automated transactions between cryptocurrency tokens on the Ethereum blockchain through smart contracts.

Cardano CFD

Cardano is a public blockchain platform that enables peer-to-peer transactions with its internal cryptocurrency, Ada. It is open-source and decentralized, with consensus achieved using proof of stake.

Binance Coin CFD

Binance Coin was initially formed as a utility token for reduced trading fees, but its uses have extended to payments for transaction fees (on the Binance Chain), travel bookings, entertainment, online services and financial services.

Avalanche CFD

Avalanche is a decentralized, open-source proof of stake blockchain platform. It uses smart contracts to support various blockchain-based projects with high transaction processing speed.

Luna CFD

One of the native tokens of the Terra network, a blockchain-based project in South Korea. Luna can be used to mint a stablecoin TerraUSD (UST) and maintain Terra stablecoins' price.

Polygon Matic CFD

Ethereum blockchain is used in the Polygon platform, which can connect and evolve Ethereum-compatible projects and blockchains. It uses a modified proof-of-stake consensus mechanism.

Moonbeam CFD

An Ethereum-compatible smart contract platform on Polkadot founded by Derek Yoo. It can simplify the process of building and/or deploying Solidity projects in a Substrate-based environment.

Kusama CFD

Kusama utilizes two types of blockchains, the relay chain and parachains in the Polkadot ecosystem. It serves like a sandbox that help testing and developing new features in early projects.

How does Cryptocurrency CFD

trading work?

Bitcoin is a digital cryptocurrency that derives its value from supply and demand factors unique to this asset class.

Bitcoin is available in a finite supply and therefore increases in price as demand increases.

Demand stems from speculative sources and more practical sources, for example Internet purchases paid for in Bitcoin.

Bitcoin also has a tendency to react to market sentiment in more traditional markets such as equities and foreign exchange, increasing during periods of negative sentiment.

Spreads

Cryptocurrency CFD

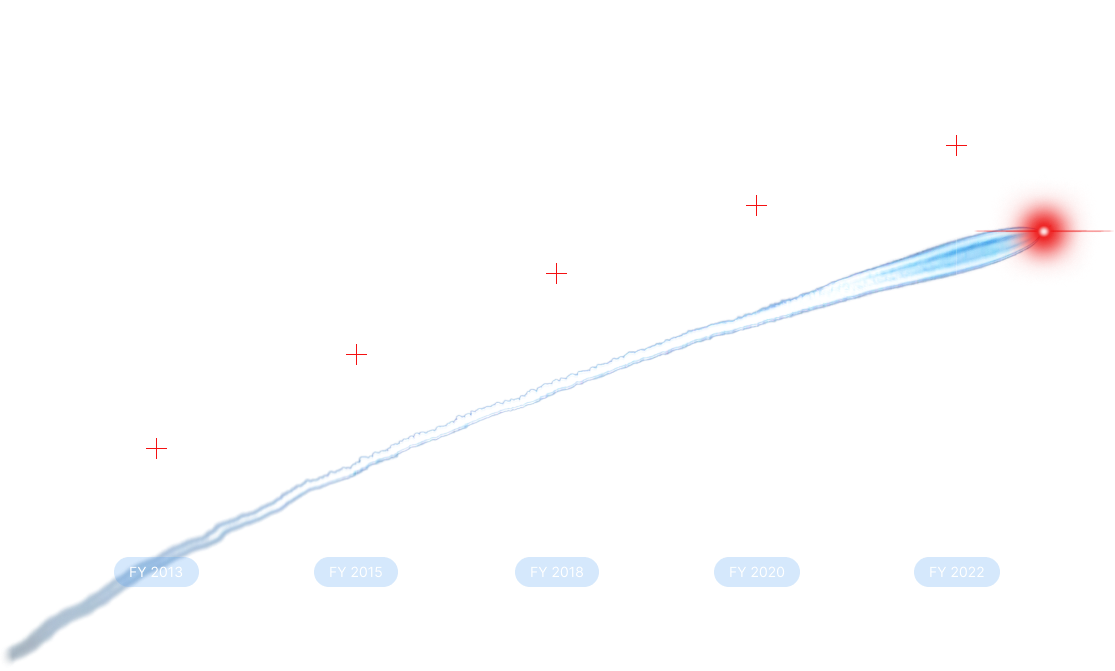

*All time total of executed orders